NPS (New Pension Scheme) V/s OPS (Old Pension Scheme)

The Old Pension Scheme for Central Government employees of India was in place before the introduction of the New Pension Scheme in 2004. Under the Old Pension Scheme, Central Government employees were entitled to a defined benefit pension upon retirement, which was calculated based on their years of service and average salary. However, with the introduction of the New Pension Scheme, Central Government employees who joined service after 2004 are now part of a defined contribution pension scheme, where the pension amount is based on the employee's contributions and market returns.

National Movement for Old Pension Scheme (NMOPS):

The National Movement for Old Pension Scheme (NMOPS) is a movement that was launched by Central Government employees who are part of the New Pension Scheme. These employees are demanding a return to the Old Pension Scheme, arguing that the New Pension Scheme is not adequate for their retirement needs. The NMOPS has been advocating for the restoration of the Old Pension Scheme for Central Government employees who joined service after 2004.

Need for Old Pension Scheme:

The NMOPS argues that the Old Pension Scheme provided more security and stability to Central Government employees, as it guaranteed a fixed pension amount based on their years of service and average salary. With the New Pension Scheme, the pension amount is subject to market fluctuations, and employees may not be able to plan for their retirement as effectively. Additionally, the NMOPS claims that the New Pension Scheme is not adequate for employees who are retiring after many years of service, as the amount of pension they receive may not be sufficient to meet their needs.

Comparison of New Pension Scheme and Old Pension Scheme:

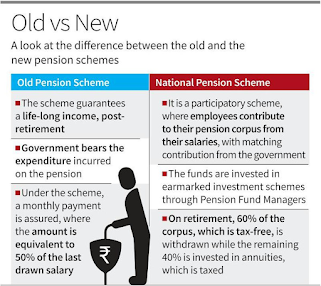

The Old Pension Scheme and the New Pension Scheme have different features and benefits. Under the Old Pension Scheme, Central Government employees were entitled to a defined benefit pension, while under the New Pension Scheme, employees contribute a percentage of their salary to a pension fund, which is invested in the market. The pension amount is based on the employee's contributions and market returns.

The Old Pension Scheme provided more security and stability to employees, as the pension amount was fixed and not subject to market fluctuations. However, the New Pension Scheme provides more flexibility to employees, as they can choose how their pension contributions are invested and have the potential to earn higher returns than under the Old Pension Scheme.

Conclusion:

The debate between the Old Pension Scheme and the New Pension

Scheme for Central Government employees is ongoing, with proponents on both

sides arguing for the benefits of their preferred scheme. While the Old Pension

Scheme provided more security and stability, the New Pension Scheme provides

more flexibility and potential for higher returns. Ultimately, the decision on

which scheme to use should be based on the needs and preferences of individual

employees, and the government should work towards providing retirement security

for all Central Government employees.

Excellent

ReplyDeleteVery good information

ReplyDelete